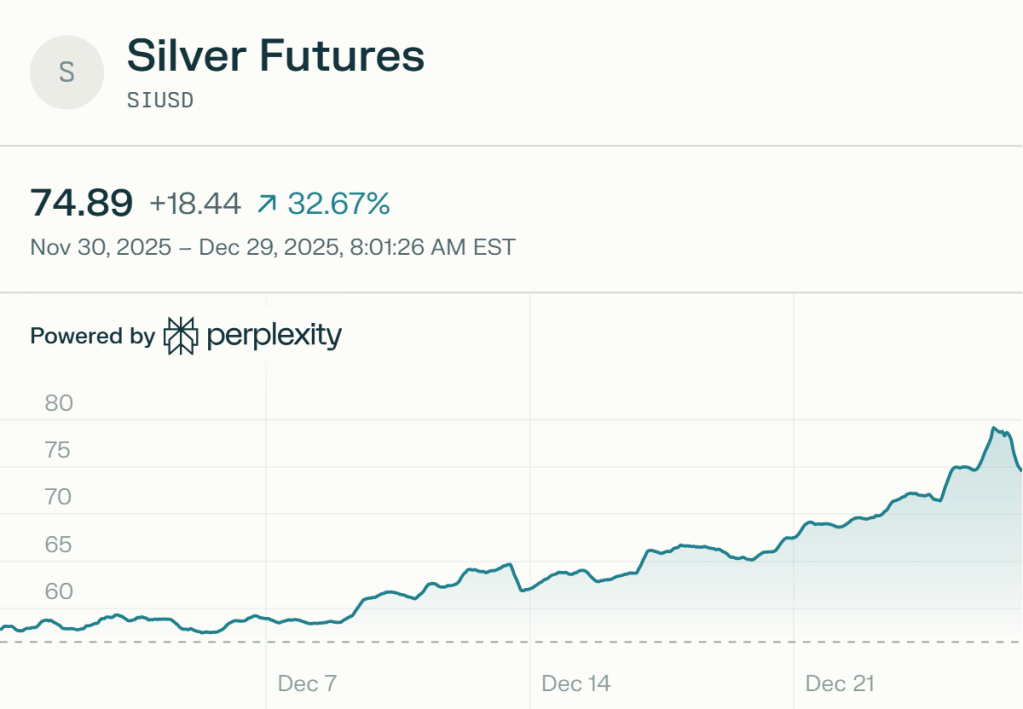

Silver prices have surged to around $74.67 per ounce amid record highs near $82, up over 170% yearly, prompting questions on whether now is the entry point for investors. Bullish fundamentals like fifth-year supply deficits and industrial demand from solar and EVs support potential gains to $88 in early January per some models, but overbought signals warn of pullbacks.

Bullish Drivers Persist

Demand outstrips supply, with ETF inflows and green tech needs pushing prices higher; forecasts like CoinCodex see $88 peaks soon, while others target $60-67 into mid-2026. Rate cuts and USD weakness favor precious metals, making silver a compelling hedge despite recent volatility.

Key Risks Ahead

RSI over 90 indicates overbought conditions, with today’s 3% drop from highs signaling profit-taking; outdated bank targets like Citigroup’s $43 (set pre-rally) highlight how fast moves can lead to corrections. Geopolitical tensions or stronger USD could cap upside.

Buy or Wait? Strategy Guide

For Times of Investing readers focused on data-driven trades, silver suits aggressive portfolios now, but cap exposure and use stops—momentum favors buyers yet demands caution in this high-regime environment.

Leave a comment