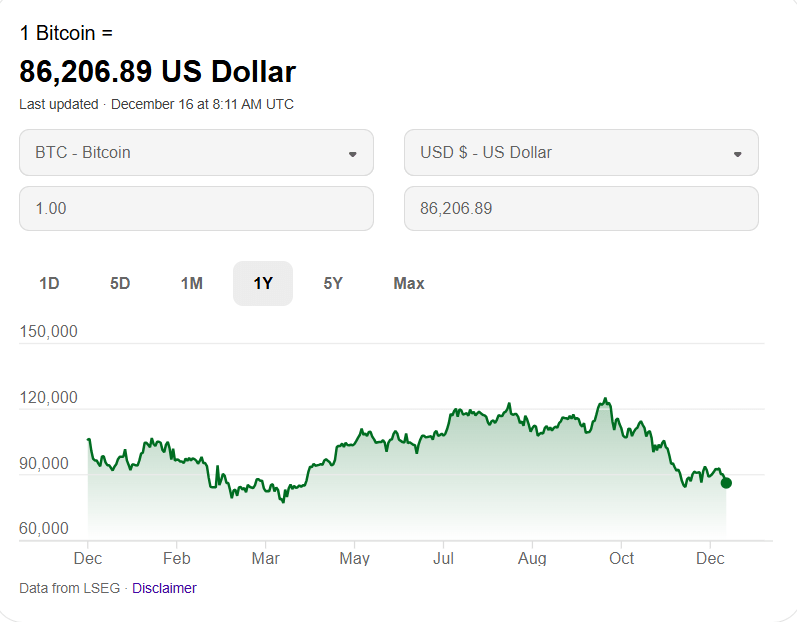

Bitcoin has extended its downward slide, hovering near $86,000–$86,500 as of December 16, 2025. This marks a roughly 30% drop from its October record high, fueled by thin holiday liquidity, significant ETF outflows, and over $500 million in long liquidations during the latest plunge. Bloomberg and Reuters highlight how low trading volumes have amplified the volatility, decoupling crypto from the modest rebound in stocks and other risk assets.

Key Drivers Behind the Plunge

Several factors are converging to pressure Bitcoin lower:

- Thin Liquidity and Holiday Slowdown: With year-end holidays approaching, trading volumes have dried up, making the market prone to sharp moves. This low-liquidity environment exaggerates price swings, as even moderate selling triggers cascading liquidations.

- ETF Outflows Intensify: Spot Bitcoin ETFs, once a major inflow driver, saw substantial redemptions last week. This reversal signals waning institutional interest amid broader risk-off sentiment.

- Liquidation Cascade: Over $500 million in leveraged long positions were wiped out in the recent drop, per data from Coinglass and Bybit. High leverage in perpetual futures markets has turned minor dips into full-blown sell-offs.

- Macro Headwinds Loom: Investors brace for pivotal U.S. jobs and inflation data this week. Weak risk appetite stems from fears of sticky inflation or a softening labor market, which could delay Federal Reserve rate cuts and hit high-beta assets like Bitcoin hardest.

Unlike traditional markets, where equities notched modest gains yesterday, Bitcoin’s isolation underscores its sensitivity to crypto-specific flows right now.

Technical Outlook: Support Levels in Focus

Bitcoin’s chart paints a bearish picture short-term. The cryptocurrency breached key support at $88,000 and eyes two-week lows around $84,000–$85,000. RSI readings flirt with oversold territory on the daily timeframe, hinting at a potential bounce, but momentum indicators remain weak.

- Resistance looms at $88,500 (recent swing high) and $90,000 (20-day EMA).

- Deeper support sits at $82,000 (November lows), with $80,000 as psychological territory.

On-chain metrics offer glimmers of resilience: Long-term holders continue accumulating, and exchange inflows have stabilized post-liquidation. Yet, with open interest elevated, further deleveraging could push prices lower.

Broader Market Context and Investor Strategies

Crypto’s decoupling from rebounding risk assets like the Nasdaq (up 0.5% yesterday) highlights its unique vulnerabilities. Ethereum and altcoins mirror Bitcoin’s pain, down 4–6% in tandem.

For investors on timesofinvesting.com, here’s how to navigate:

- Stay Cautious on Leverage: Avoid overexposure in thin markets—spot positions or low-leverage trades only.

- Watch U.S. Data Closely: Thursday’s jobs report and Friday’s PCE inflation could swing sentiment. Strong data might extend the slide; softer prints could spark a relief rally.

- Diversify Beyond BTC: Consider stablecoins or precious metals like gold (hitting fresh highs) for hedges amid macro uncertainty.

- Long-Term View: Bitcoin’s fundamentals—halving cycle, institutional adoption—remain intact. Dips like this have historically preceded bounces.

Bitcoin’s resilience through past cycles suggests this slide is temporary turbulence, not a trend reversal. As macro clarity emerges, expect volatility to persist but opportunities to arise.

Leave a comment