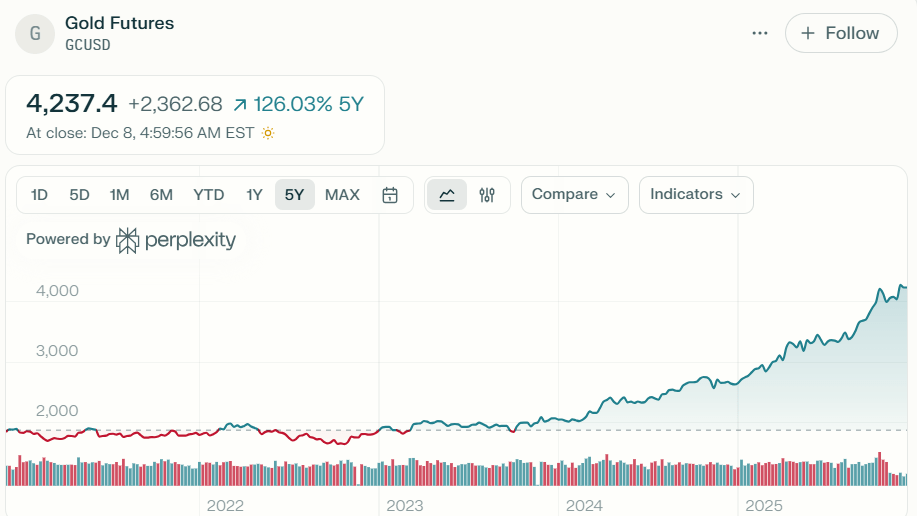

Gold is marching into 2026 with one of the strongest bull narratives in decades, and big Wall Street names are finally catching up to what gold bugs have been saying for years. With forecasts clustering in a broad 4,400–5,000 USD/oz band for XAU/USD – and some calls even higher – the metal is increasingly being treated not just as a hedge, but as a core macro trade for the coming cycle.roboforex+3

Why gold’s 2026 story matters

The setup into 2026 is simple: record debt, sticky fiscal deficits, and a world that is steadily diversifying away from the dollar. In that environment, gold benefits from three powerful forces at once: central‑bank accumulation, expectations of lower real interest rates, and recurring waves of “risk off” whenever geopolitics or growth fears flare up. For investors, XAU/USD is no longer a sleepy inflation hedge – it is evolving into a high‑conviction macro asset tied directly to the global monetary regime.investing+4

What the big players are forecasting

Several major institutions have now put aggressive numbers on the table for 2026, and even the more conservative houses still assume prices well above past cycles. While no forecast is guaranteed, these targets help frame the risk–reward for anyone positioning around gold over the next 12–24 months.reuters+4

Key 2026 gold targets (XAU/USD)

| Institution / source | 2026 view (approx) | Main narrative |

|---|---|---|

| Bank of America | Peak/target around 5,000; average near 4,400 USD/ozreuters | US debt stress, de‑dollarisation, central‑bank demand |

| Goldman Sachs | Around 4,900 USD/oz by end‑2026investing | EM central‑bank buying plus ETF inflows as Fed cuts |

| RoboForex analyst set | Broad band roughly 3,950–4,950; base ~4,500 USD/ozroboforex | Structural bull trend, weaker real yields |

| LiteFinance analysts | Year‑end zone roughly 4,578–5,431 USD/ozlitefinance | Geopolitics and investment demand on top of jewellery |

| Citi (select scenarios) | More cautious: consolidation near low‑to‑mid 3,000sroboforex | Gold positive but less explosive if growth, rates hold up |

For timesofinvesting.com readers, this spread of views is more important than any single target. It shows a consensus around “higher for longer” in gold, with disagreement mainly about how aggressive the upside can be.litefinance+3

The macro engine behind XAU/USD

Three macro themes dominate almost every 2026 gold outlook. First, central banks – especially in emerging markets – are steadily swapping a slice of their FX reserves into bullion, a trend many strategists expect to continue as geopolitical blocs harden. Second, as rate‑cut cycles advance and real yields ease, the opportunity cost of holding gold falls, which historically supports sustained bull legs in XAU/USD. Third, persistent geopolitical risk and concerns about sovereign debt sustainability act as an options‑like kicker, with each flare‑up pushing new capital into perceived safe havens.markets.chroniclejournal+6

Trading and investing angles for 2026

For active traders, the 2026 landscape argues for treating dips as opportunities within a structural uptrend rather than blindly chasing parabolic spikes. Building scenarios – a base case near the 4,400–4,900 region, an upside blow‑off towards or beyond 5,000, and a downside consolidation in the low‑to‑mid 3,000s – can help define position size, stop‑losses, and profit targets on XAU/USD and gold‑linked instruments. Longer‑term investors can see gold as a portfolio “shock absorber,” sizing allocations according to risk tolerance, correlation with existing holdings, and views on inflation, recession risk, and currency debasement.interest+5

For timesofinvesting.com, the key takeaway is clear: unless the macro backdrop changes dramatically, gold in 2026 looks less like a speculative fad and more like a core strategic theme. Readers watching Kiyosaki‑style crisis narratives, central‑bank flows, and Fed policy shifts will want XAU/USD firmly on their radar as the next phase of this hard‑asset cycle unfolds.library+3

- https://roboforex.com/beginners/analytics/forex-forecast/commodities/gold-xau-usd-forecast-and-prediction/

- https://www.reuters.com/business/finance/bofa-hikes-gold-price-forecast-5000oz-2026-2025-10-13/

- https://www.investing.com/news/commodities-news/goldman-sachs-raises-its-gold-price-target-to-4900-by-end2026-4274295

- https://www.litefinance.org/blog/analysts-opinions/gold-price-prediction-forecast/

- http://markets.chroniclejournal.com/chroniclejournal/article/marketminute-2025-10-29-world-bank-strikes-gold-forecast-predicts-continued-price-surge-through-2026

- https://www.metal.com/en/newscontent/103407157

- https://www.interest.co.nz/investing/136481/gold%E2%80%99s-outlook-2026-being-defined-uncertain-economic-environment-investors

- https://www.fxempire.com/forecasts/article/gold-price-forecast-fed-pivot-and-weak-data-set-stage-for-a-rally-toward-6000-in-2026-1564629

- https://www.perplexity.ai/search/ba50a61a-a04b-4aac-ab4e-243d42f98785

Leave a comment