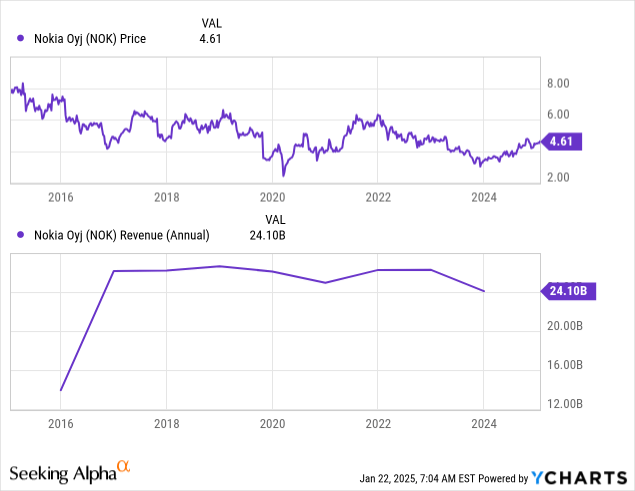

The telecom world is abuzz as Nokia unleashes its Q3 2025 earnings, delivering a beat that underscores its AI and 5G prowess. With shares spiking nearly 10% in pre-market trading to $6.10—eclipsing the 52-week high of $5.79—the Finnish powerhouse is proving its strategic pivot is paying dividends. Closing at $5.55 yesterday (October 22), the stock has climbed 29% YTD, fueled by contract wins and tech innovations. For investors eyeing growth in connectivity and data centers, this report signals Nokia’s resurgence in 2025. Dive into the details, backed by fresh data, and see why this could be a prime opportunity.

Nokia Stock Performance Chart

Earnings Highlights: Beats and Growth Across the Board

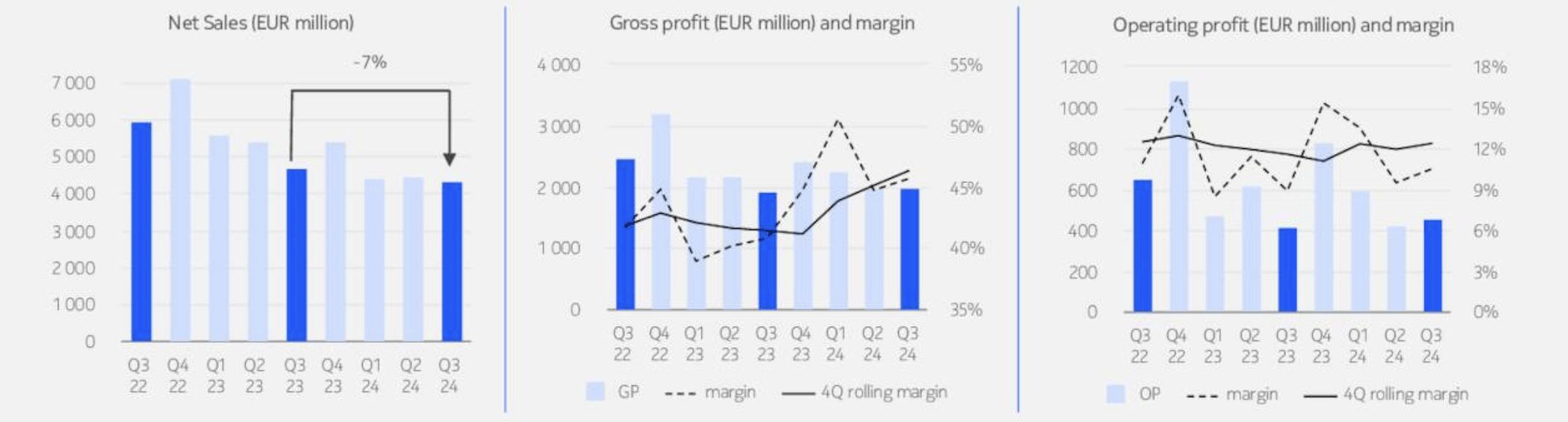

Nokia’s Q3 shone bright with a 9% year-over-year net sales increase to approximately €4.83 billion, driven by contributions from all business groups. Adjusted operating profit soared to €435 million, crushing Bloomberg estimates of €324 million, thanks to AI-fueled demand. While reported profit dipped 54% to €80 million (€0.01 per share) from €175 million last year—likely due to one-offs—the comparable figures highlight operational strength.

Net cash rose by €122 million to €3.001 billion, bolstering the balance sheet. The company reaffirmed its full-year 2025 outlook, with minor tweaks for venture fund reporting, signaling confidence amid market volatility. Volume spiked to over 66 million shares, more than double the average, reflecting investor enthusiasm.

Nokia Q3 Financial Metrics Overview

Strategic Wins Fueling the Momentum

Building on pre-earnings hype, Nokia’s recent contracts—like the Vodafone-Vodacom 5G expansion in Europe and Africa, and the £2 billion UK upgrade—continue to drive growth. Eco-friendly deals, such as the 24% energy-saving 5G network with Rakuten Mobile in Japan and 20% savings with Elisa in Finland and Estonia, align with global sustainability pushes.

Under CEO Justin Hotard, the $2.3 billion Infinera acquisition and new AI-focused organization—led by Pallavi Mahajan—position Nokia at the heart of the “AI supercycle.” Hotard emphasizes connectivity’s role in data centers, a bet that’s materializing in these results.

Market Reaction and Analyst Views

Pre-market gains of 9.91% to $6.10 suggest a bullish open, potentially extending the 21% monthly and 12% YTD rally. Analysts maintain a “Moderate Buy” rating with a $5.32 target, but upgrades like BNP Paribas Exane’s “Outperform” highlight AI synergies. Trading at 28x earnings, slightly above historical but below peers, some note overbought signals (RSI >70), yet the earnings beat could propel further upside.

Smart Plays for Investors in 2025

Capitalize on this momentum with these tips:

- Track AI Integration: Nokia’s data center focus could yield long-term gains—monitor post-earnings calls for updates.

- Diversify with Telecom ETFs: Balance Nokia with broader exposure to mitigate sector risks.

- Watch for Pullbacks: High RSI? Consider entry on dips for value.

- ESG Angle: Green initiatives make it a fit for sustainable portfolios.

Nokia’s blend of legacy telecom and cutting-edge AI makes it a compelling watch.

Final Thoughts: Ride the Wave or Wait?

Nokia’s Q3 beat reaffirms its turnaround, with AI and 5G as catalysts for 2025 growth. As shares eye new highs, this could be your cue to invest in connectivity’s future. Check timesofinvesting.com for in-depth analyses, tools, and more. What’s your Nokia move? Share in the comments!

Leave a comment