In the high-stakes world of biotech investing, breakthroughs can skyrocket stocks, but setbacks can send them tumbling. Moderna’s recent announcement to scrap its mRNA-1647 cytomegalovirus (CMV) vaccine program after a dismal Phase 3 trial is a stark reminder of the risks—and opportunities—in this volatile sector. With efficacy rates scraping as low as 6%, this once-promising candidate aimed at preventing birth defects has been shelved, shaking investor confidence but not derailing the company’s broader ambitions. For savvy investors in 2025, this could be a buying dip or a warning sign—let’s break it down with the latest data and what it means for your portfolio.

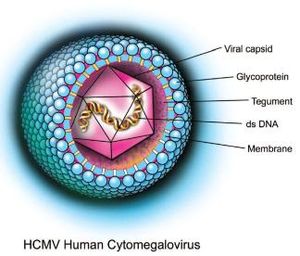

Illustration of the CMV Virus

The Trial That Fell Short

Moderna’s ambitious push beyond COVID-19 vaccines hit a snag when topline results from the largest CMV vaccine trial ever—enrolling about 7,500 women aged 16-40 across 13 countries—revealed efficacy of just 6% to 23% in preventing infection in seronegative women of childbearing age. Far below the company’s targets, this failure marks the end of development for the congenital CMV program, which targeted a virus that’s a leading cause of birth defects like hearing loss and developmental issues in newborns.

CEO Stéphane Bancel expressed disappointment, noting the impact on families and healthcare pros awaiting a breakthrough. Despite the letdown, the vaccine was well-tolerated with no safety flags from the monitoring board. CMV, a sneaky DNA virus from the herpes family, often lurks latent but can reactivate, causing serious complications—especially in pregnancies or transplant patients.

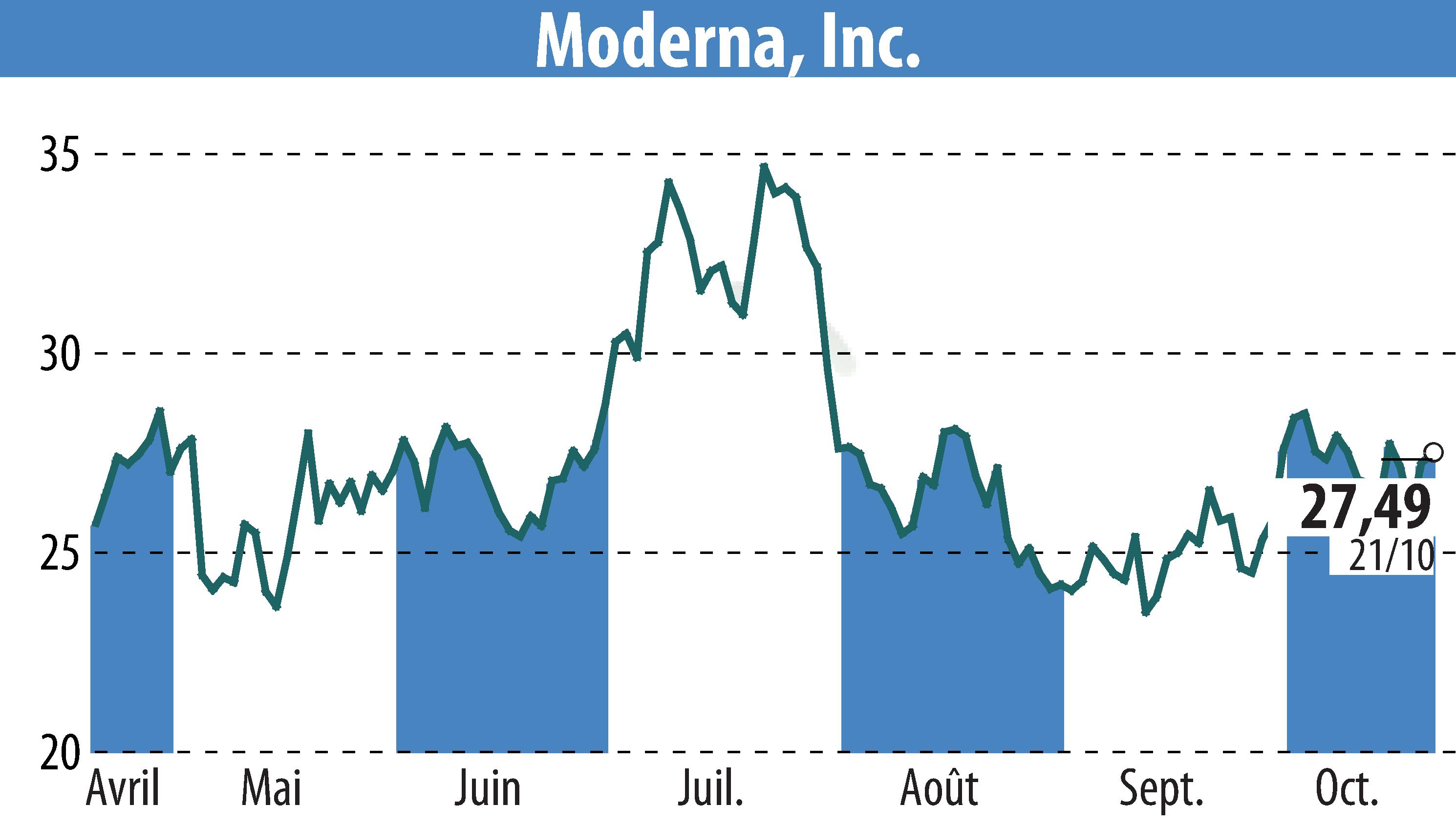

Moderna Stock Chart Post-Announcement

Stock Shockwaves and Financial Fallout

The news hit hard: Moderna’s shares dipped about 5% in after-hours trading, reflecting dashed hopes for what was pegged as a potential $2-5 billion annual sales blockbuster by company execs (analysts were more conservative at $1.6 billion). This CMV shot was seen as a key pipeline asset, diversifying from COVID reliance, but its flop underscores the biotech gamble where Phase 3 failures aren’t uncommon.

Yet, Moderna remains optimistic: The setback won’t touch 2025 financial guidance or the 2028 breakeven goal, as initial revenue from mRNA-1647 was expected to be minimal amid launch investments. President Stephen Hoge highlighted ongoing Phase 2 work in bone marrow transplant patients, where CMV reactivation poses big risks—signaling not all is lost.

What This Means for Investors in 2025

Biotech investing thrives on innovation, but events like this highlight the need for diversification. Moderna’s mRNA platform still powers a robust pipeline, including flu, RSV, and cancer vaccines, which could drive future growth. For risk-tolerant investors, this dip might present a value play—shares have been volatile, but long-term believers see upside in the tech.

Key takeaways:

- Assess Pipeline Depth: Look beyond one program; Moderna’s COVID success funded this R&D, and they’re pivoting focus.

- Watch for Buying Opportunities: Post-setback dips often precede rebounds if core business holds strong—monitor earnings calls.

- Diversify Biotech Bets: Pair with stable pharma giants or ETFs to buffer trial risks.

- Stay Informed on Health Tech: CMV affects 1 in 200 newborns; future vaccines could still emerge from competitors.

This setback is a bump, not a bust, in the biotech race—perfect for those eyeing resilient innovators.

Final Thoughts: Navigate the Volatility

Moderna’s CMV halt is a tough pill, but it spotlights the thrilling uncertainty of investing in cutting-edge health solutions. As markets evolve in 2025, keep an eye on how companies like this adapt. Head to timesofinvesting.com for more biotech breakdowns, stock tips, and updates. What’s your take on Moderna’s future? Share below!

Leave a comment