Imagine earning money while you sleep—regular cash payouts from your investments that grow over time, providing financial freedom without lifting a finger. That’s the allure of dividend investing. In a world where market volatility is the norm, dividends offer stability and compounding power that can turn modest savings into substantial wealth. Whether you’re a novice building your first portfolio or a pro seeking reliable income streams, dividend strategies are hotter than ever in 2025, especially with economic recoveries and rising interest in sustainable payouts. Let’s explore how to harness this “magic” for your financial future, with real data and actionable insights.

Why Dividends Are the Smart Choice Now

Dividends aren’t just extra cash; they’re a sign of company health and investor rewards. In 2025, with inflation cooling and corporate earnings rebounding, high-quality dividend stocks are shining. Jim Cramer calls them “magic” for younger investors because reinvesting payouts amplifies returns dramatically over time. For instance, focusing on dividend growth—companies that consistently increase payouts—has proven resilient through market cycles.

Historical data backs this: From 1950 to 2020, reinvesting dividends in the S&P 500 turned $1 into over $1,800, versus just $200 without them. Today, strategies like targeting higher-yield ETFs or stocks with yields up to 7% are gaining traction, offering passive income that beats traditional savings.

The Power of Dividend Growth

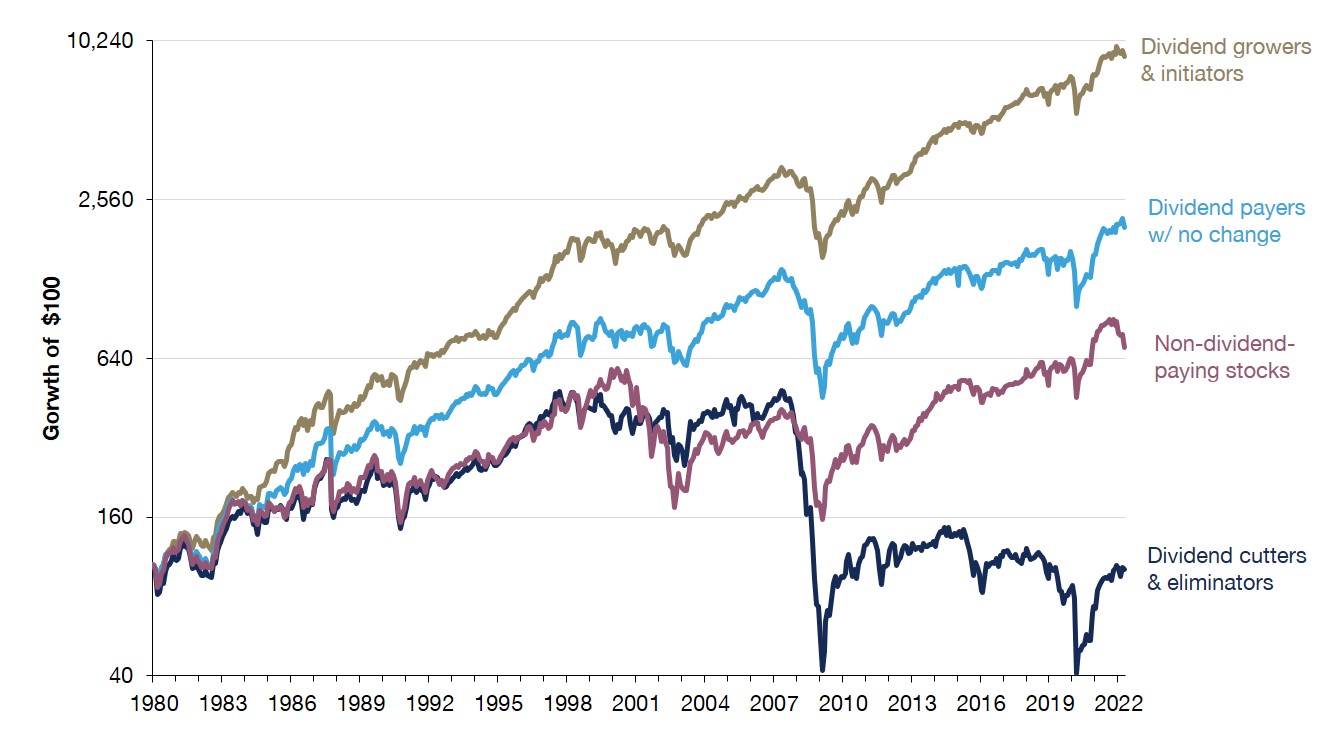

Dividend growth investing zeros in on firms with a track record of hiking payouts, signaling strong fundamentals. In changing markets, these “growers” often outperform, adding value through compounding, stability, and inflation protection. For 2025, experts highlight strategies blending steady payers with emerging ones for balanced income.

Aiming for $1,000 monthly passive income? You’d need about $300,000 in a portfolio yielding 4%—achievable with top dividend ETFs earning Gold or Silver ratings from Morningstar. High-dividend stocks potentially topping the list this year include those with solid earnings to sustain payouts, even in uncertain times.

Dividend Growth vs. Other Stocks Over Time

Practical Strategies to Build Your Dividend Portfolio

Ready to dive in? Here’s how to get started with engaging, beginner-friendly steps:

- Select Quality Over Yield: Prioritize companies with consistent increases, like Dividend Aristocrats. Avoid chasing ultra-high yields that might signal risk.

- Use ETFs for Diversification: Opt for high-dividend ETFs with strong analyst coverage for easy entry and higher yields than the market average.

- Reinvest for Compounding: Automate dividend reinvestment to supercharge growth—perfect for long-term wealth building.

- Monitor and Adjust: Track payout ratios and free cash flow to ensure sustainability. In 2025, focus on sectors like utilities and consumer staples for reliability.

Dividend investing isn’t about get-rich-quick; it’s about steady, rewarding progress that aligns with life goals like retirement or funding dreams.

Final Thoughts: Your Path to Financial Freedom

In 2025, dividend strategies stand out as a reliable way to generate passive income amid evolving markets. By focusing on growth and quality, you can build a portfolio that pays you back—literally. Visit timesofinvesting.com for more guides, stock picks, and tools to kickstart your journey. What’s your favorite dividend stock? Drop it in the comments!

Leave a comment