In the fast-paced world of finance, one question echoes endlessly: “Is now the right time to invest?” With markets hitting all-time highs, economic uncertainties, and headlines screaming about potential crashes, it’s easy to feel paralyzed. But here’s the truth that could change your financial future: it’s not about timing the market—it’s about time in the market. Whether you’re a beginner dipping your toes into stocks or a seasoned investor rethinking your strategy, understanding this principle can lead to substantial long-term gains. Let’s dive into why staying invested pays off, backed by data and real-world insights.

The Myth of Market Timing

Market timing sounds appealing—who wouldn’t want to buy low and sell high? However, it’s notoriously difficult, even for professionals. Attempting to predict short-term fluctuations often leads to missed opportunities. Research shows that even poorly timed investments outperform sitting on the sidelines. For instance, if you invested in the stock market at its peak, history indicates that peaks are frequently followed by further growth rather than immediate drops.

Consider this: Over the past 20 years, missing just the 10 best days in the market could slash your returns by more than half. The key takeaway? The best time to invest was yesterday, but the second-best time is today. In 2025, with global economies recovering and innovations in AI and green energy driving growth, hesitation could cost you dearly.

Historical Proof: Time Trumps Timing

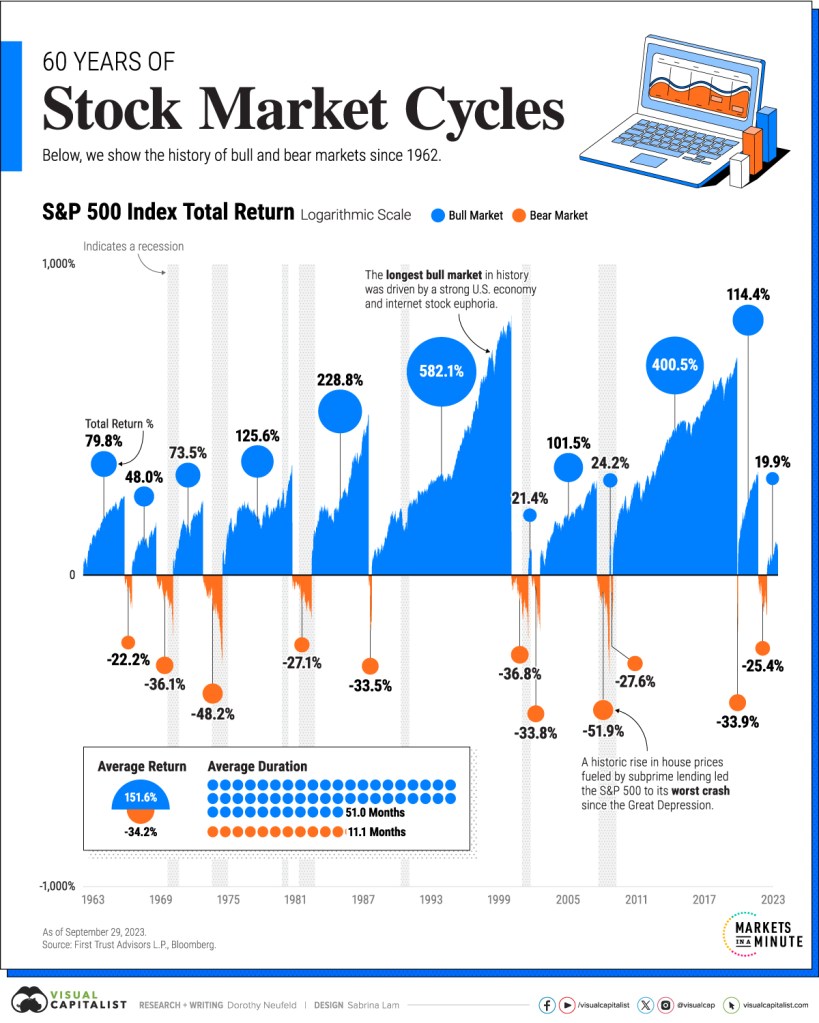

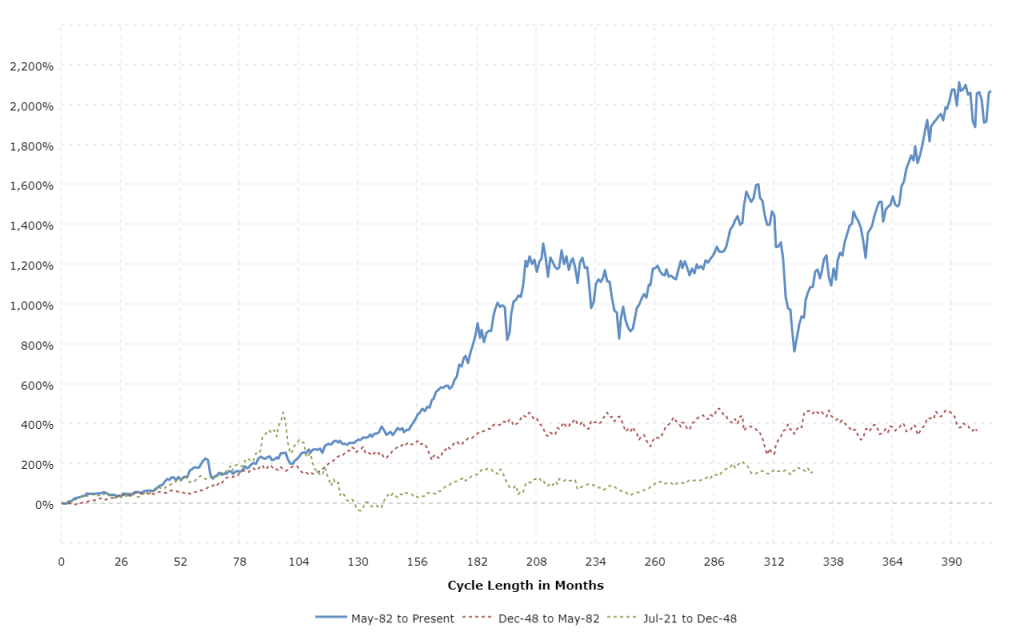

Look back at the data: From 2015 to 2025, retail investing has surged, with more people transferring funds into accounts than ever before. Those who stayed invested through volatility—think pandemics, inflation spikes, and geopolitical tensions—reaped rewards. A classic example is the S&P 500, which has delivered average annual returns of around 10% over long periods, despite short-term dips.

Even during “lost decades,” like the early 2000s, patient investors who didn’t panic-sell came out ahead. The adage holds true: “It’s not about timing the market, but about time in the market.” In fact, hands-off investors often outperform those who frequently buy and sell, as emotional decisions lead to lower returns—sometimes by as much as 1.2% annually.

Practical Tips to Get Started in 2025

Ready to put this into action? Here are some engaging strategies to make investing interesting and accessible:

- Diversify with ETFs: Spread your risk across sectors like tech, renewables, and healthcare. Low-cost index funds have historically beaten active management over time.

- Embrace Dollar-Cost Averaging: Invest a fixed amount regularly, regardless of market highs or lows. This averages out your costs and reduces the impact of volatility.

- Focus on Short-Term Safety if Needed: For conservative approaches, consider high-yield savings or short-term bonds yielding competitive rates in today’s environment.

- Stay Informed, Not Reactive: Follow trends like sustainable investing or crypto integration, but avoid knee-jerk reactions to daily news.

Investing isn’t just about numbers—it’s about building wealth that aligns with your life goals, whether that’s early retirement, funding adventures, or securing your family’s future.

Final Thoughts: Start Your Journey Today

In a world obsessed with quick wins, the real secret to investing success is patience and consistency. As markets evolve in 2025, remember that every day you wait is a day of potential growth missed. Head over to timesofinvesting.com for more tips, tools, and updates to fuel your financial adventure. What’s your first step? Share in the comments below—we’d love to hear!

Leave a comment