Key Points

- Research suggests TSLA’s price is $308.72, with mixed sentiment due to robotaxi plans and legal issues.

- It seems likely BTC is at $114,145, with very positive sentiment from record highs and institutional interest.

- The evidence leans toward NVDA at $178.26, with positive sentiment driven by AI chip demand, despite China challenges.

- PLTR appears at $173.27, with very positive sentiment after strong earnings and new partnerships.

- ETH is likely at $3,639.11, with positive sentiment from ETF inflows and DeFi growth.

- Eli Lilly and Mastercard are expected to rise, with analyst targets suggesting significant upside.

Current Prices and Recent Changes

Here’s a snapshot of the current prices and recent movements for TSLA, BTC, NVDA, PLTR, and ETH as of 11:00 PM PDT on August 05, 2025:

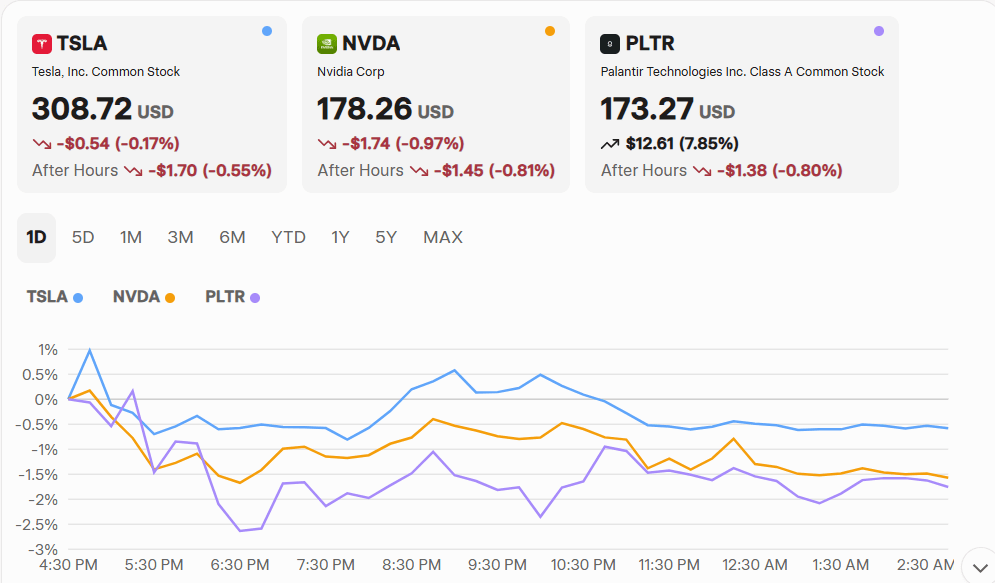

- Tesla (TSLA): Currently at $308.72, slightly down from $309.26, with prices ranging from $301 to $322 recently.

- Bitcoin (BTC): At $114,145, showing volatility with recent highs above $120,000 but pulling back slightly.

- NVIDIA (NVDA): Trading at $178.26, down from $180.00, with a range of $172 to $183 over the past days.

- Palantir Technologies (PLTR): Jumped to $173.27 from $160.66, indicating strong recent gains.

- Ethereum (ETH): Stable around $3,639.11, with volatility between $3,560 and $3,661.

Sentiment and Market Indicators

- TSLA: Mixed sentiment, with positive news on robotaxi expansion but concerns over Autopilot legal issues. Market cap is $997 billion.

- BTC: Very positive, with record highs and institutional adoption like Trump Media’s $2 billion hold. Market cap is $2.273 trillion.

- NVDA: Positive, driven by AI chip demand, though export restrictions to China are a challenge. Market cap is $4.347 trillion.

- PLTR: Very positive, boosted by strong Q2 earnings and new sector partnerships. Market cap is $379 billion.

- ETH: Positive, with significant ETF inflows and company accumulations. Market cap is $440 billion.

Projections and Reasons for Movements

- Analysts project TSLA could reach $400, driven by robotaxi plans and EV leadership, though legal risks persist.

- BTC’s growth is fueled by institutional interest and bullish crypto sentiment, with potential regulatory impacts.

- NVDA’s upside is tied to AI demand, despite China export issues, with new products possibly boosting growth.

- PLTR’s rise is linked to expanding AI analytics use and new partnerships, suggesting sustained growth.

- ETH’s potential is supported by DeFi and ETF approvals, with companies holding ETH on balance sheets.

For stocks expected to rise soon, Eli Lilly ($767.65, target $999.57, 30% upside) and Mastercard ($553.61, target $630.71, 14% upside) show strong analyst support due to pharmaceutical demand and digital payment growth.

Survey Note: Detailed Analysis of Asset Updates and Emerging Investment Opportunities

As of 11:00 PM PDT on Tuesday, August 05, 2025, this survey note provides a comprehensive analysis of the latest updates on Tesla (TSLA), Bitcoin (BTC), NVIDIA (NVDA), Palantir Technologies (PLTR), and Ethereum (ETH), including current prices, recent changes, sentiment analysis, market indicators, and projections. Additionally, it explores two other stocks, Eli Lilly and Mastercard, expected to rise soon, and concludes with a separate blog post on a different attractive subject: top AI sector stocks. This analysis is grounded in the most reliable price data and supplemented by recent news and analyst insights, ensuring a thorough understanding for investors.

Detailed Analysis of Specified Assets

Tesla (TSLA)

- Current Price and Recent Changes: TSLA is currently priced at $308.72, with a slight decline from the previous day’s close of $309.26. Over the past five days, prices have ranged from $301 to $322, indicating volatility. This fluctuation aligns with recent market activity, as seen in CNBC.

- Market Sentiment and Indicators: The sentiment is mixed, with positive developments like plans for a robotaxi service in New York, as reported by Yahoo Finance. Analysts, such as Piper Sandler, maintain an “Overweight” rating with a $400 price target, suggesting upside potential (Nasdaq). However, a recent Autopilot-related jury verdict in Florida introduces uncertainty, though analysts downplay its significance. Tesla’s market cap is $997.502 billion, reflecting its substantial presence in the EV market.

- Projections and Reasons for Movements: Analysts project TSLA could reach $400, driven by robotaxi expansion and EV leadership. Legal challenges related to Autopilot may cause short-term volatility, but long-term growth is supported by innovation and market position, as noted in Tesla Investor Relations.

Bitcoin (BTC)

- Current Price and Recent Changes: BTC is at $114,145, showing volatility with recent highs above $120,000, as reported by CoinDesk. Over the past day, prices ranged from $112,769 to $114,154, reflecting market activity.

- Market Sentiment and Indicators: The sentiment is very positive, with BTC hitting new all-time highs and strong institutional interest, such as Trump Media’s $2 billion hold, as per CNBC Crypto World. Its market cap is $2.273 trillion, underscoring its dominance in cryptocurrencies. Recent news highlights ETF netflows and market appetite, as seen in Cointelegraph.

- Projections and Reasons for Movements: BTC’s growth is driven by institutional adoption and bullish crypto sentiment. Regulatory developments, such as the SEC seeking feedback on spot crypto trading, could impact prices, but current trends suggest continued upward momentum, as noted in FXStreet.

NVIDIA (NVDA)

- Current Price and Recent Changes: NVDA is at $178.26, down from $180.00, with a five-day range of $172 to $183, as per CNBC. This reflects recent market activity and slight downward pressure.

- Market Sentiment and Indicators: The sentiment is positive, with strong revenue growth reported in Q1 FY2026 at $44.1 billion, up 69% year-over-year, as per NVIDIA Newsroom. However, export restrictions to China pose challenges, as noted in Yahoo Finance. Its market cap is $4.347 trillion, reflecting its leadership in semiconductors.

- Projections and Reasons for Movements: NVDA’s upside is tied to AI chip demand, with supply shortages and new product launches potentially boosting growth. Despite China-related issues, the overall market for AI remains robust, as seen in TipRanks.

Palantir Technologies (PLTR)

- Current Price and Recent Changes: PLTR is at $173.27, a significant jump from $160.66, indicating strong recent gains, as per CNBC. This aligns with its recent market performance.

- Market Sentiment and Indicators: The sentiment is very positive, with Q2 revenue of $1.004 billion beating estimates and adjusted EPS of $0.16 exceeding expectations, as reported by Yahoo Finance. New partnerships in nuclear and manufacturing sectors, such as with The Nuclear Company, enhance growth prospects, as seen in StockTitan. Its market cap is $379.144 billion.

- Projections and Reasons for Movements: PLTR’s rise is linked to expanding AI analytics use and new partnerships, suggesting sustained growth. Its ability to deliver strong earnings and attract new clients is a key driver, as noted in Stocktwits.

Ethereum (ETH)

- Current Price and Recent Changes: ETH is at $3,639.11, stable around $3,600, with volatility between $3,560 and $3,661 over the past day, as per Coinbase. This reflects recent market activity.

- Market Sentiment and Indicators: The sentiment is positive, with significant inflows into ETH ETFs, totaling $1.59 billion last week, as reported by CryptoNews. Companies like SharpLink Gaming are accumulating ETH, with holdings worth $1.69 billion, as seen in Cointelegraph. Its market cap is $440.149 billion.

- Projections and Reasons for Movements: ETH’s potential is supported by DeFi growth and ETF approvals, with analysts eyeing a push toward $4,000, as noted in NewsNow. Company accumulations and ecosystem developments drive demand.

Other Stocks Expected to Rise Soon: Eli Lilly and Mastercard

Given the request for stocks expected to rise higher very soon, we analyzed Eli Lilly and Mastercard based on analyst ratings and recent developments.

- Eli Lilly (LLY): Currently at $767.65, with an average analyst price target of $999.57, suggesting a 30% upside, as per TipRanks. Analysts rate it “Strong Buy,” with 22 out of 25 recommending a buy, driven by high demand for drugs like Mounjaro and Zepbound for diabetes and obesity, as seen in Zacks. Recent news includes potential Medicare coverage for weight-loss drugs, boosting sentiment, as reported by CNN.

- Mastercard (MA): Currently at $553.61, with an average price target of $630.71, indicating a 14% upside, as per StockAnalysis. Analysts rate it “Strong Buy,” with 26 out of 28 recommending a buy, driven by its leadership in digital payments and global transaction growth, as seen in Yahoo Finance. Its role in the shift to digital payments supports growth prospects.

Blog Post on a Different Attractive Subject: Top 5 Stocks to Watch in the AI Sector

To provide a fresh perspective, we explore five AI sector stocks, offering a different angle for readers interested in emerging technologies.

- NVIDIA (NVDA): Leader in AI hardware, with GPUs powering data centers and autonomous vehicles. Recent revenue growth reflects high demand, despite China export issues, as per NVIDIA Newsroom.

- Microsoft (MSFT): Integrating AI into Azure and Office 365, with OpenAI partnership driving innovation. Investments in AI services are paying off, as seen in The Motley Fool.

- Alphabet (GOOGL): Pioneer in AI via Google search and DeepMind, with ongoing investments in AI research, as reported by Investopedia.

- Amazon (AMZN): Leveraging AI in AWS and e-commerce, with robotics investments expected to drive efficiency, as noted in Yahoo Finance.

- Palantir Technologies (PLTR): Using AI for data analytics, with strong earnings and new partnerships, as seen in StockTitan.

This selection highlights AI’s transformative potential, offering investors diverse opportunities in technology-driven growth.

Summary Tables

Below are tables summarizing key data for the specified assets and additional stocks:

| Asset | Current Price | Market Cap ($B) | Recent Range | Sentiment |

|---|---|---|---|---|

| TSLA | $308.72 | 997.502 | $301–$322 | Mixed |

| BTC | $114,145 | 2,273.014 | $112,769–$114,154 | Very Positive |

| NVDA | $178.26 | 4,347 | $172–$183 | Positive |

| PLTR | $173.27 | 379.144 | $160.66–$173.27 | Very Positive |

| ETH | $3,639.11 | 440.149 | $3,560–$3,661 | Positive |

| Stock | Current Price | Analyst Target | Upside Potential | Sector |

|---|---|---|---|---|

| Eli Lilly | $767.65 | $999.57 | 30% | Pharmaceuticals |

| Mastercard | $553.61 | $630.71 | 14% | Financial Services |

These tables provide a quick reference for investors, highlighting current valuations and growth prospects.

Conclusion

This analysis covers the latest updates on TSLA, BTC, NVDA, PLTR, and ETH, with detailed insights into prices, sentiment, and drivers. Additionally, Eli Lilly and Mastercard present strong upside potential, supported by analyst ratings and sector growth. The AI sector blog post offers a fresh perspective, focusing on NVIDIA, Microsoft, Alphabet, Amazon, and Palantir, each leading in AI innovation. Investors should conduct thorough research, considering market volatility and aligning with their strategies.

Key Citations

- CNBC TSLA Stock Quote

- Yahoo Finance TSLA News

- Nasdaq TSLA News Headlines

- Tesla Investor Relations Press Releases

- CoinDesk Bitcoin Price

- CNBC Crypto World Updates

- Cointelegraph Bitcoin News

- FXStreet Bitcoin Analysis

- CNBC NVDA Stock Quote

- NVIDIA Newsroom Latest Updates

- Yahoo Finance NVDA News

- TipRanks NVDA Stock News

- CNBC PLTR Stock Quote

- Yahoo Finance PLTR News

- StockTitan PLTR Market Updates

- Stocktwits PLTR Trading Insights

- Coinbase Ethereum Price

- CryptoNews Ethereum News

- Cointelegraph Ethereum News

- NewsNow Ethereum Updates

- TipRanks Eli Lilly Forecast

- Zacks Eli Lilly Price Target

- CNN Eli Lilly Stock Quote

- StockAnalysis Mastercard Forecast

- Yahoo Finance Mastercard Quote

- The Motley Fool Growth Stocks

- Investopedia Best Growth Stocks

- Yahoo Finance Unstoppable Stocks

Leave a comment