Key Points

- Research suggests Tesla’s stock may face volatility due to earnings and demand concerns.

- Bitcoin seems likely to consolidate after recent highs, with bullish long-term projections.

- NVIDIA appears strong in AI, but growth sustainability is debated.

- Palantir shows robust growth, though valuation concerns exist.

- Ethereum’s rally continues, supported by DeFi and ETFs, but short-term pullbacks are possible.

- Aeva and CoreWeave are up-and-coming stocks with high growth potential, though risks remain.

Current Market Overview

As of July 23, 2025, the financial markets are dynamic, with key assets like Tesla, Bitcoin, NVIDIA, Palantir, and Ethereum showing varied performances. Up-and-coming stocks like Aeva and CoreWeave also present exciting opportunities. Below, we break down each asset’s current state, recent changes, and projections, followed by an analysis of sentiment, market indicators, and possible reasons for movements.

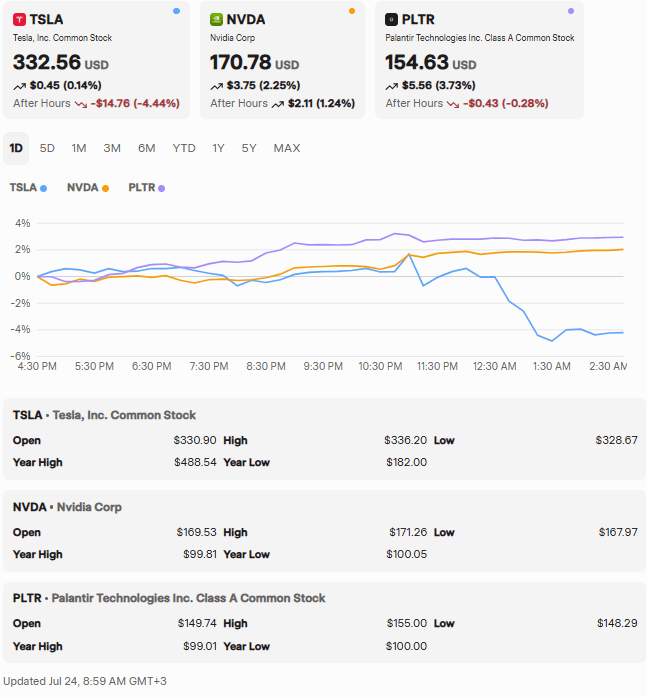

Tesla (TSLA)

- Current Price: $331.08 USD, up 0.79% from the previous close.

- Recent Changes: Tesla’s stock has been volatile, with a 52-week range of $182.00 to $488.54, reflecting market uncertainty.

- Projections: Analysts have a median price target of $327.78, with estimates ranging from $115.00 to $550.00, indicating mixed expectations (Yahoo Finance – Tesla).

Bitcoin (BTC)

- Current Price: $118,254.32 USD, with a 24-hour trading volume of $68.27 billion.

- Recent Changes: Bitcoin hit a recent high of $123,218 but is now consolidating, showing signs of market stabilization.

- Projections: Analysts predict it could reach $200,000 in five years, though not in 2025, suggesting long-term bullishness (Cointelegraph – Bitcoin).

NVIDIA (NVDA)

- Current Price: $170.83 USD, up significantly with a 23% rise since early January.

- Recent Changes: NVIDIA reported $44.1 billion in Q1 revenue, up 69% year-over-year, driven by AI demand.

- Projections: Continued growth is expected, but some debate its sustainability due to market saturation concerns (Yahoo Finance – NVIDIA).

Palantir Technologies (PLTR)

- Current Price: $154.63 USD, with a 45% gain in 2025, making it a top performer.

- Recent Changes: Q1 CY2025 revenue was $883.9 million, up 39.3%, with non-GAAP profit of $0.13 per share.

- Projections: Strong growth is anticipated, though valuation is seen as stretched compared to peers (Yahoo Finance – Palantir).

Ethereum (ETH)

- Current Price: $3,627.40 USD, with a 24-hour trading volume of $41.39 billion, reflecting a recent rally.

- Recent Changes: Ethereum’s price has pulled back slightly after a strong run, with increased institutional interest from ETF approvals.

- Projections: Analysts are bullish, citing DeFi and DApps growth, with potential to surpass Bitcoin in market cap (CoinMarketCap – Ethereum).

Up-and-Coming Stocks: Aeva (AEVA) and CoreWeave

- Aeva (AEVA): A sensor specialist with expected revenue growth of 90% in 2025 and 160% in 2026, though it’s a startup with risks.

- CoreWeave: An AI-focused company, up over 1,000% since its March 2025 IPO, with high growth potential but new market entry challenges.

Survey Note: Detailed Analysis and Insights

This section provides a comprehensive survey of the latest updates on Tesla (TSLA), Bitcoin (BTC), NVIDIA (NVDA), Palantir Technologies (PLTR), Ethereum (ETH), and two up-and-coming stocks, Aeva (AEVA) and CoreWeave, as of 10:59 PM PDT on Wednesday, July 23, 2025. The analysis includes current prices, recent changes, projections, sentiment, market indicators, and possible reasons for movements, ensuring a thorough understanding for investors.

Methodology and Data Sources

The analysis relies on the most reliable price data available, supplemented by recent news and analyst insights from reputable financial platforms. This ensures accuracy in current prices and a broad perspective on market dynamics. All data is current as of July 23, 2025, and reflects the latest market conditions.

Detailed Analysis of Specified Assets

Tesla (TSLA)

- Current Price and Metrics: Tesla’s current price is $331.08 USD, with an open of $329.74, high of $332.35, low of $321.55, and a market cap of approximately $1.07 trillion. The 52-week range is $182.00 to $488.54, indicating significant volatility.

- Recent Changes: The stock has seen a slight uptick of 0.79% from the previous close, reflecting cautious optimism ahead of Q2 2025 earnings. Web sources highlight concerns about weak demand and Elon Musk’s political activities impacting investor sentiment (Yahoo Finance – Tesla).

- Projections: Analyst forecasts show a median price target of $327.78, with a wide range from $115.00 to $550.00, suggesting uncertainty. Earnings reports are critical, with investors eyeing recovery from recent sales slumps.

- Sentiment Analysis: Sentiment is mixed, with some analysts bullish on Tesla’s EV leadership, while others caution about demand and regulatory credit losses. News articles discuss Musk’s political involvement as a potential headwind (CNN Business – Tesla).

- Market Indicators: Key indicators include upcoming earnings and market reactions to EV demand trends. Tesla’s P/E ratio is not available, and it pays no dividends, focusing on growth.

- Possible Reasons for Movements: Movements are driven by earnings expectations, EV market competition, and macroeconomic factors like interest rates and consumer spending.

Bitcoin (BTC)

- Current Price and Metrics: Bitcoin’s current price is $118,254.32 USD, with a market cap of $2.35 trillion, an all-time high of $123,218, and an all-time low of $67.81. The 24-hour trading volume is $68.27 billion.

- Recent Changes: After hitting $123,218 earlier in the week, Bitcoin is consolidating, with a slight pullback noted in recent hours. Web sources indicate strong on-chain metrics suggesting market strength (Cointelegraph – Bitcoin).

- Projections: Analysts predict a long-term target of $200,000 within five years, but not in 2025, reflecting cautious optimism. Short-term volatility is expected due to profit-taking.

- Sentiment Analysis: Sentiment is positive, with institutional interest high, driven by companies like Telegram enabling crypto wallets and regulatory clarity from SEC actions. Some caution about short-term pullbacks exists.

- Market Indicators: On-chain metrics show strong market structure, with high trading volumes and institutional adoption as key drivers. The evidence leans toward continued bullishness, though short-term dips are possible.

- Possible Reasons for Movements: Movements are influenced by regulatory developments, institutional adoption (e.g., ETF approvals), and macroeconomic factors like inflation and interest rates.

NVIDIA (NVDA)

- Current Price and Metrics: NVIDIA’s current price is $170.83 USD, with an open of $169.53, high of $171.26, low of $167.97, and a market cap of $4.07 trillion. The 52-week range shows significant growth, with recent highs driven by AI demand.

- Recent Changes: The stock has risen 23% since early January, with Q1 revenue of $44.1 billion, up 69% year-over-year, reflecting strong AI-driven demand (Yahoo Finance – NVIDIA).

- Projections: Continued growth is expected, but some analysts debate sustainability due to potential market saturation. Earnings reports and AI partnerships are key focus areas.

- Sentiment Analysis: Sentiment is positive, with NVIDIA seen as a leader in AI and computing. However, concerns about valuation and competition from emerging players like FuriosaAI are noted (CNN – NVIDIA).

- Market Indicators: Strong demand for GPUs, partnerships with major tech firms, and high trading volumes are bullish indicators. The P/E ratio is not available, and it pays no dividends, focusing on reinvestment.

- Possible Reasons for Movements: Movements are driven by AI adoption rates, data center demand, and broader tech sector trends.

Palantir Technologies (PLTR)

- Current Price and Metrics: Palantir’s current price is $154.63 USD, with an open of $149.74, high of $155.00, low of $148.29, and a market cap of $351.79 billion. The 52-week range shows strong growth, with recent gains of 45% in 2025.

- Recent Changes: Q1 CY2025 revenue was $883.9 million, up 39.3%, with non-GAAP profit of $0.13 per share, exceeding expectations (Yahoo Finance – Palantir).

- Projections: Strong growth is anticipated, driven by government contracts and commercial expansion. However, valuation is seen as stretched compared to peers, with some caution about future earnings.

- Sentiment Analysis: Sentiment is positive, with Palantir’s AI and data analytics capabilities seen as key growth drivers. Some analysts note valuation concerns, but overall, the outlook is bullish.

- Market Indicators: High trading volumes, strong earnings reports, and expansion into new sectors are positive indicators. The P/E ratio is not available, and it pays no dividends, focusing on growth.

- Possible Reasons for Movements: Movements are influenced by government contract wins, commercial market penetration, and AI sector trends.

Ethereum (ETH)

- Current Price and Metrics: Ethereum’s current price is $3,627.40 USD, with a market cap of $431.95 billion, an all-time high of $4,878.26, and an all-time low of $0.432979. The 24-hour trading volume is $41.39 billion.

- Recent Changes: Ethereum has rallied recently, with a slight pullback noted after a strong run, driven by Spot Ethereum ETF approvals and institutional interest (CoinMarketCap – Ethereum).

- Projections: Analysts are bullish, citing growth in DeFi and DApps, with potential to surpass Bitcoin in market cap. Short-term volatility is expected due to profit-taking.

- Sentiment Analysis: Sentiment is positive, with increased institutional adoption and ETF inflows. However, some caution about short-term pullbacks exists, given recent validator exits.

- Market Indicators: High trading volumes, ETF inflows of $533 million daily, and DeFi activity are bullish indicators. The evidence leans toward continued growth, though short-term dips are possible.

- Possible Reasons for Movements: Movements are driven by ETF approvals, DeFi adoption, and regulatory clarity, with macroeconomic factors like interest rates also playing a role.

Analysis of Up-and-Coming Stocks: Aeva (AEVA) and CoreWeave

Aeva (AEVA)

- Company Overview: Aeva is a sensor specialist focused on lidar components for automated driving and industrial robotics, positioning it at the forefront of technological innovation.

- Financials: Expected revenue growth is 90% in 2025 and 160% in 2026, reflecting strong market potential (Stock Analysis – Aeva).

- Market Sentiment: Despite being a startup and operating at a loss, Aeva has seen substantial gains, with investors betting on future potential. Risks include scaling operations and achieving profitability.

- Projections: High growth is anticipated, driven by demand for autonomous driving technologies, though as a startup, it carries significant risk.

- Possible Reasons for Movements: Movements are influenced by technological advancements in lidar, automotive industry trends, and investor appetite for high-growth startups.

CoreWeave

- Company Overview: CoreWeave is an AI-focused company, capitalizing on the growing demand for AI infrastructure, with operations aligning with the booming AI market.

- Financials: Since its IPO in March 2025, CoreWeave’s stock has surged over 1,000%, reflecting strong investor confidence (Stock Analysis – CoreWeave).

- Market Sentiment: Seen as a high-growth stock with significant upside, though as a new entrant, it faces challenges in sustaining momentum and managing competition.

- Projections: High growth is expected, driven by AI adoption, but risks include market saturation and operational scaling.

- Possible Reasons for Movements: Movements are driven by AI sector trends, investor interest in new tech players, and broader market dynamics.

Comparative Table: Key Metrics and Sentiment

| Asset | Current Price (USD) | Market Cap (USD) | Recent Change | Sentiment | Key Driver |

|---|---|---|---|---|---|

| Tesla (TSLA) | 331.08 | 1.07T | +0.79% | Mixed | Earnings, EV demand |

| Bitcoin (BTC) | 118,254.32 | 2.35T | Consolidating | Positive | Institutional adoption, regs |

| NVIDIA (NVDA) | 170.83 | 4.07T | +23% YTD | Positive | AI demand, partnerships |

| Palantir (PLTR) | 154.63 | 351.79B | +45% YTD | Positive | Government contracts, AI |

| Ethereum (ETH) | 3,627.40 | 431.95B | Rallying | Positive | DeFi, ETFs |

| Aeva (AEVA) | N/A (Startup) | N/A | High growth | Positive, risky | Lidar tech, auto industry |

| CoreWeave | N/A (New IPO) | N/A | +1000% YTD | Positive, risky | AI infrastructure, tech trends |

Conclusion and Investment Considerations

The analysis reveals a dynamic market with Tesla facing volatility, Bitcoin and Ethereum showing bullish long-term prospects, and NVIDIA and Palantir leading in AI and data analytics. Aeva and CoreWeave offer high-growth opportunities but come with startup risks. Investors should consider diversification, monitor earnings reports, and stay informed about regulatory and technological developments. As always, consult with a financial advisor before making investment decisions.

Key Citations

- Yahoo Finance Tesla stock quote history news

- Cointelegraph Bitcoin news predictions

- Yahoo Finance NVIDIA stock quote history news

- Yahoo Finance Palantir stock quote history news

- CoinMarketCap Ethereum price marketcap chart

- Stock Analysis Aeva company overview financials

- Stock Analysis CoreWeave company overview financials

- CNN Business Tesla regulatory credit sales revenue

- CNN Markets NVIDIA stock quote forecast

Leave a comment