Welcome to Times of Investing! The financial markets are buzzing with action, and today, we’re diving into the latest updates on some of the most talked-about assets: Tesla ($TSLA), Bitcoin ($BTC), NVIDIA ($NVDA), Palantir ($PLTR), and Ethereum ($ETH). Plus, we’ll spotlight two up-and-coming stocks—CoreWeave (CRWV) and ThredUp (TDUP)—that are poised for explosive growth. Whether you’re a seasoned investor or just curious, this post will break down current prices, recent trends, sentiment, and what’s driving these markets, all as of July 20, 2025. Let’s get started!

Tesla ($TSLA): Electric Dreams with a Political Twist

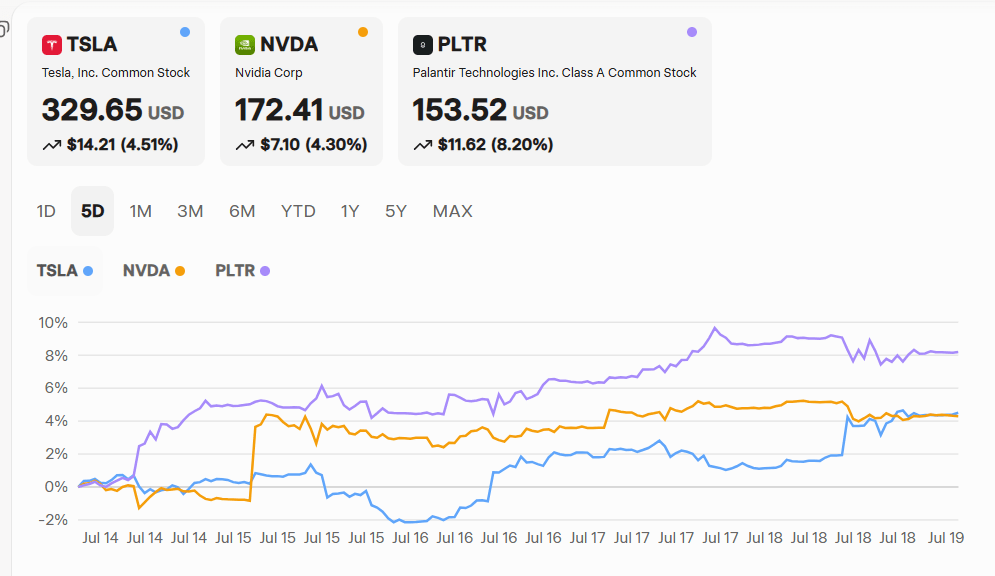

Current Price: $329.65 USD

Recent Movement: Over the past five days, Tesla’s stock has fluctuated between $315.40 and $330.90, climbing from $319.41.

Sentiment: Mixed, with a 64% buy rating on platforms like STAKE, up from 30-40% recently, but caution lingers due to Elon Musk’s political moves.

What’s Driving It? Tesla’s poised for a record Q3 with 460,000 vehicle deliveries, a 6% year-over-year increase, boosting optimism. However, Musk’s recent political party announcement has sparked bearish chatter on X, with some investors worried about brand perception. Market indicators show Tesla trading above its 50-day and 200-day moving averages, with a $1.01 trillion market cap signaling strong fundamentals.

Projection: Analysts see upside if delivery numbers hold, but political noise could cap gains. Keep an eye on earnings reports for clarity.

Bitcoin ($BTC): Fear Signals Opportunity

Current Price: $117,927.00 USD

Recent Movement: Bitcoin’s been steady, ranging from $117,786.44 to $118,482.24 in the last 24 hours.

Sentiment: The Fear and Greed Index is at “Extreme Fear,” lower than during the FTX collapse, suggesting a potential bullish reversal. X posts highlight whale accumulation amid retail panic, a classic contrarian signal.

What’s Driving It? With a $2.35 trillion market cap, Bitcoin’s holding above key moving averages. Regulatory news, institutional adoption, and macroeconomic shifts are key drivers. Low sentiment, as noted on X, often precedes rallies, especially with whales buying dips.

Projection: If support levels hold, Bitcoin could rebound, potentially testing its all-time high of $122,838.00. Watch for regulatory updates and ETF flows.

NVIDIA ($NVDA): AI Giant Faces Tariff Turbulence

Current Price: $172.41 USD

Recent Movement: Down slightly over five days, ranging from $165.26 to $174.25, from $173.00.

Sentiment: Cautious to bearish, with a recent downgrade from “Buy” to “Neutral” by New Street Research. X posts point to tariff concerns, given 20% of NVIDIA’s revenue comes from China.

What’s Driving It? NVIDIA’s $4.02 trillion market cap reflects its AI dominance, but tariffs and export controls are headwinds. The stock’s below its 50-day moving average but above the 200-day, signaling mixed trends. Some X users call it oversold, hinting at a potential bounce.

Projection: Short-term challenges may persist, but long-term AI demand could drive recovery. Monitor tariff developments closely.

Palantir ($PLTR): High Hopes, High Risks

Current Price: $153.52 USD

Recent Movement: Volatile, ranging from $141.75 to $154.92 over five days, slightly down from $153.99.

Sentiment: Bearish, with Jefferies’ “Underperform” rating at $28 and X posts citing insider selling (CEO Alex Karp sold over $1B). Some see a relief bounce possible.

What’s Driving It? Palantir’s $335.34 billion market cap is fueled by government contracts, but high valuations and insider sales raise red flags. Trading above moving averages, its RSI suggests overvaluation.

Projection: Risk of a pullback looms, but strong contracts could stabilize it. Investors should weigh valuation concerns against growth potential.

Ethereum ($ETH): Staking Changes Spark Hope

Current Price: $3,645.45 USD

Recent Movement: Stable, ranging from $3,587.76 to $3,645.45 in the last day.

Sentiment: Mixed, with social sentiment at a yearly low, potentially signaling a bounce. X posts highlight upcoming staking changes in ETFs as a game-changer.

What’s Driving It? Ethereum’s $439.99 billion market cap is supported by network upgrades like Dencun and staking developments expected in Q2 2025. Low open interest suggests reduced risk appetite, but ETF optimism could shift momentum.

Projection: A rebound is possible if staking changes materialize. Watch for ETF updates and broader crypto sentiment.

Rising Stars: CoreWeave and ThredUp

Looking for the next big thing? Here are two up-and-coming stocks stealing the spotlight:

CoreWeave (CRWV): The AI Infrastructure Powerhouse

Current Price: ~$153.00 USD

Recent Movement: Year-to-date gains of 298.8%, though down from a high of $187.00.

Why It’s Hot: CoreWeave’s building the backbone for AI, with revenue projected to double from $5B in 2025 to $11B in 2026. Strategic moves like acquiring Core Scientific and securing contracts with OpenAI and IBM fuel its growth.

Sentiment and Outlook: Mixed analyst ratings but strong fundamentals make it a top pick. Volatility is a risk, with a -24.55% downside potential, but AI demand could push it higher.

Why Invest? If you’re bullish on AI, CoreWeave’s a must-watch for its infrastructure play.

ThredUp (TDUP): Sustainable Fashion’s Breakout Star

Current Price: $7.35 USD

Recent Movement: A whopping 459.7% year-to-date gain, driven by record revenue and gross margins.

Why It’s Hot: ThredUp’s virtual thrift shop is capitalizing on sustainable fashion trends. Recent earnings beats, raised guidance, and AI-driven shopping enhancements are boosting conversion rates.

Sentiment and Outlook: Analysts rate it a “Buy” with a $7.25 target, reflecting confidence in its growth. The $906 million market cap suggests room to run.

Why Invest? With eco-conscious consumers on the rise, ThredUp’s a leader in a booming sector.

Why This Matters for Investors

The markets are a rollercoaster, but opportunities abound. Tesla and Ethereum show growth potential, while NVIDIA and Palantir face near-term hurdles. Bitcoin’s low sentiment could be a contrarian buy signal. Meanwhile, CoreWeave and ThredUp are riding megatrends in AI and sustainability, making them exciting picks for bold investors. Stay informed, weigh the risks, and align your moves with your financial goals.

Follow Times of Investing for more market insights, and let us know your thoughts in the comments!

Sources: Yahoo Finance, StockAnalysis, U.S. News, and X posts from Cointelegraph, TrendSpider, and more, as of July 20, 2025.

Leave a comment