With the U.S. easing restrictions on AI chip exports to China, Nvidia and AMD stocks have rallied hard — and fast. Investors who caught the move early are now sitting on significant gains. But as the dust settles, a more important question emerges:

Is it time to sell?

Let’s break down the current landscape and outline a smart, informed strategy for managing your positions in these two high-profile tech names.

Nvidia (NVDA): Profit-Taking or Further Upside?

The Setup

Nvidia has staged an impressive rebound. The stock recently reclaimed its 200-day moving average and confirmed a technical “golden cross” — a strong signal that bullish momentum remains intact.

Where It Could Go

Short-term resistance is forming around the $178–$180 level. If Nvidia breaks above that zone on strong volume, the next target could be as high as $190–$200. However, as the price approaches these levels, the risk-to-reward ratio begins to narrow.

When to Sell

- Take partial profits around $178–$180 if you entered at lower levels. This is a natural resistance zone, and selling into strength is a strategic move.

- If momentum fades or broader tech starts to wobble, it makes sense to exit or reduce your position.

- Set a stop-loss around $159 to protect gains. A close below this level would invalidate the bullish setup and suggest potential downside.

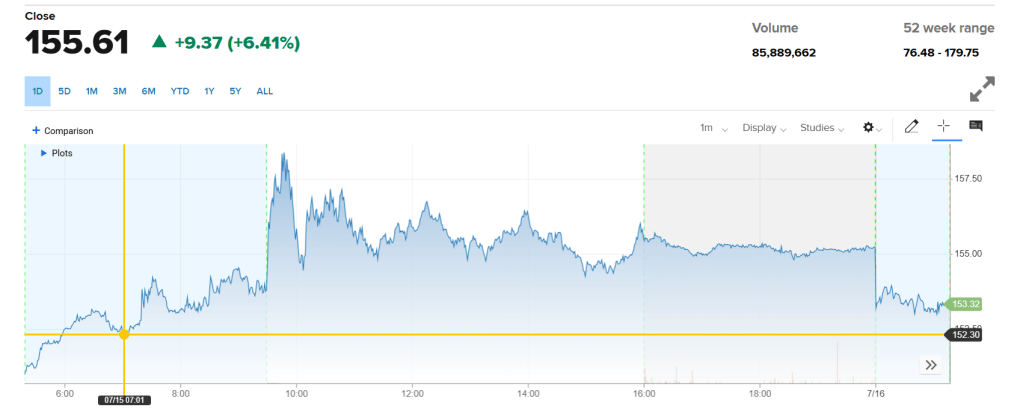

AMD (AMD): Strong Momentum, But Near Key Levels

The Setup

AMD has ridden the wave of optimism surrounding AI chip exports as well, bolstered by bullish analyst reports and strong technical momentum. Recently, Bank of America raised its price target to $175, while HSBC remains optimistic about the company’s competitive position in the AI market.

Where It Could Go

AMD faces potential resistance at $175, with some optimistic projections pointing as high as $215 in a best-case scenario. However, with the stock already up sharply, approaching $175 may be a natural time for some profit-taking.

When to Sell

- Consider selling a portion of your position at $175, which aligns with key technical resistance and analyst targets.

- Use a trailing stop near $150–$143 to remain in the trade while locking in gains.

- If AMD slips below those levels, particularly on heavy volume, it may be time to reassess your position.

Technical Summary

| Stock | Target Profit Zone | Trailing Stop Level |

|---|---|---|

| Nvidia | $178–$180 | $159 |

| AMD | $175 | $150–$143 |

Other Factors to Watch

Aside from the charts and analyst price targets, a few external variables could disrupt or accelerate these stocks:

- Policy shifts: The current U.S.-China export policy could change quickly, particularly if new tariffs or geopolitical concerns arise.

- Earnings reports: Keep an eye on Nvidia and AMD’s upcoming quarterly guidance. Forward-looking statements regarding China sales will be critical.

- Macroeconomic signals: Inflation data and Fed decisions could weigh on tech stocks, regardless of strong individual performance.

Final Thoughts

This isn’t about timing the top perfectly — it’s about managing risk and locking in gains. Nvidia and AMD have both delivered solid upside. If you’ve been riding this wave, now is the time to develop a disciplined exit strategy.

Take profits at logical resistance zones. Protect your position with stop-losses. And stay vigilant on news that could shift sentiment in a heartbeat.

There’s no shame in taking gains off the table. In fact, the smartest investors do exactly that.

Leave a comment